tax on forex trading nz

The tax rate is 33 of the trading income. Forexpedia The original forex trading glossary.

Daily Asia London Sessions Watchlist Aud Nzd Economic Indicator Job Opening Financial Markets

Where you are trading with the intention of selling for a profit in a short space of time gains will be taxable.

. Hi I am planning to trade in NZX ASX AND FOREX MARKET. Now you can move to choosing a platform for Forex Trading NZ. Currently New Zealand is considered a safe haven for forex brokers.

A DIL license application is distinctly different from applying for FSP Registration for the Trading financial products or foreign exchange on behalf of other persons category. Is IRD chasing those individual traders. Tell your provider that is your bank fund manager or financial.

For 18 months during 2016 to 2017 Wiremu worked part-time as a taxi driver. The truth about forex trading. All NZ citizens and residents pay either Resident Withholding Tax RWT or tax at the Prescribed Investor Rate PIR on income from savings and investments in New Zealand.

Wiremu spent between 4 and 5 hours most days checking and studying the market. People trade in forex either to try to make a quick profit by betting on the changing value of a currency or to provide certainty about the cost of future foreign currency payments called hedgingThe risk of online foreign exchange trading is high. Amount of traders in New Zealand 270 000 Updated April 2022.

Certainly like any other gainful activity trading and investing are subject to taxes. New Zealand Tax Deposits And the Forex Industry. Unfortunately Blackbull Markets only offers a demo.

Spread betting is currently not liable for capital gains tax but its not beyond doubt that this could change. Yes including capital gains tax. 20-30 dollars gain in a week is very small.

Such investors must stick to the general taxation rules. The taxable value of transactions of more than Rs 10 Lakh is Rs 5500 01 of the transaction amount. I do operate under a limited company in this country currently trading stocks and considering forex.

CMC Markets - Excellent overall best platform technology. Forex traders can start with even 1. During this time he invested 30000 in the cryptoasset market.

Since there are no restrictions on the amount to be traded many new. Is Forex Trading Tax-Free In New Zealand. Who is the number 1 Forex Broker offering NZ denominated accounts.

What does this mean for New Zealands forex industry. The company keeps customers funds at ANZ bank which implies a high level of security. Best time to trade in New Zealand.

First-in first-out FIFO First-in last-out FILO Minimise capital gain. Spot forex traders are considered 988 traders and can deduct. We regularly receive complaints and enquiries from consumers who have lost.

Here is our list of the top forex brokers in New Zealand. Under this definition regular for profit currency trading may count as income subject to. Blackbull Markets was founded in 2014 and is incorporated licensed and operated in New Zealand.

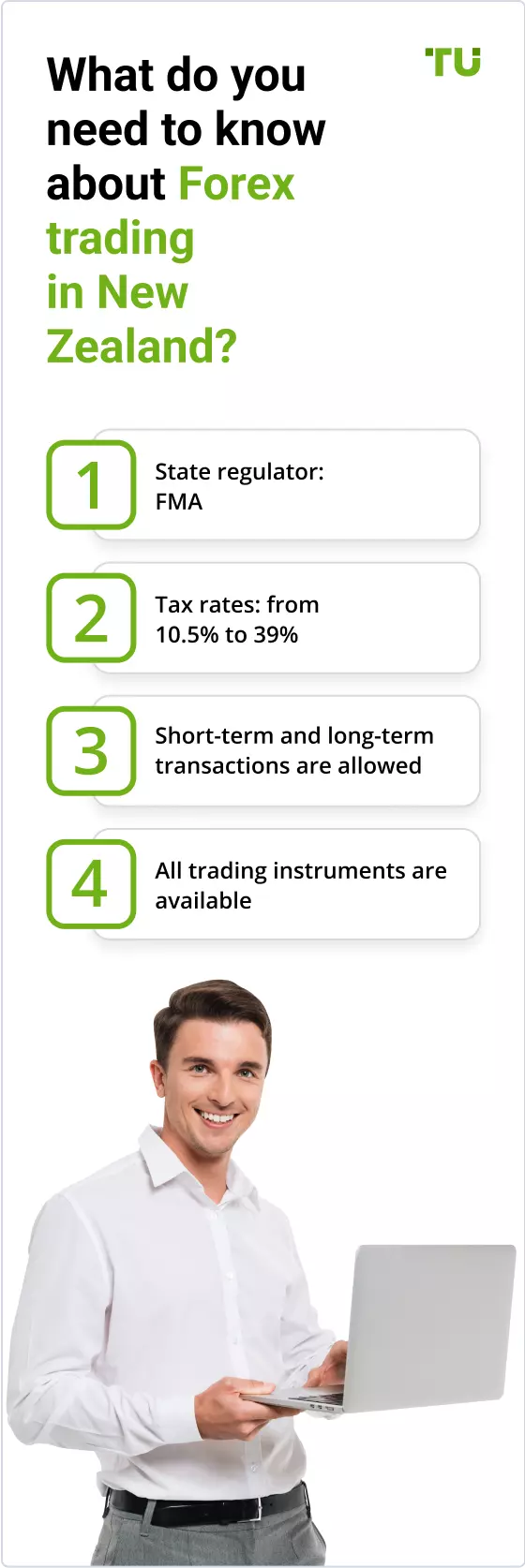

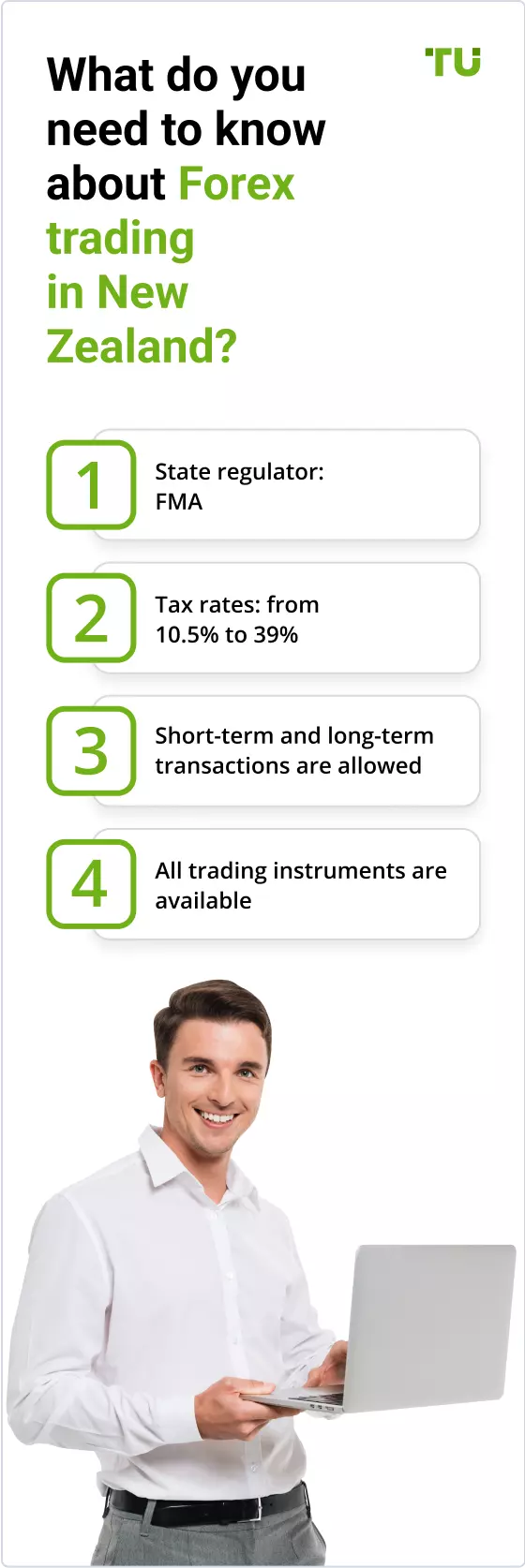

If you are also classified as a self-employed trader you may have to pay income tax. Up to 14000 105 up to 48000 175 up to 70000 30 and so on. The company offers forex trading on MetaTrader 4 and MetaTrader 5 the two most popular trading platforms.

For the 202021 tax year HMRC has established a Capital Gains tax-free allowance of 12300 6150 for trusts so investors will only be taxed on their overall gains above the allowance amount. Sharesights Traders Tax report calculates any taxable gains using one of four methods. Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses treated as long-term capital gains and 40 as.

Companies in Cyprus are tax free on stocks and bonds but the capital gain of 125 applies to forex profits. Apart from these GST implications forex traders must also pay charges. Aspiring forex traders should consider tax implications before getting started on trading.

New Zealand boasts a relatively strong economy free from the. To ensure you are fully compliant with New Zealand forex tax laws its best to speak to an accountant before. Calculate gainslosses on NZ shares for tax purposes.

Governments regularly changes tax laws as they find new and innovative ways to earn income from you. Videos and tip-offs to newstipsstuffconz or. I cant find any guides in the IRD website that would assist me on how much should I pay.

0900 - 1200 and 1500 - 1600 WAT. BlackBull Markets - 35 Stars. Although this tax is making me think twice.

Due to the nature of CFD products FMA. You need to choose the correct tax rate or you could face an unexpected bill at the end of the tax year. CFDs are liable to capital gains tax.

But the question is is it taxable. In New Zealand forex traders must pay tax on the profits made from selling a currency if the currency was bought with the intention of resale. Sadly this does not mean CFD trading is tax-free capital gains tax is still applied to any gains made from CFD trading.

IG - Best overall broker most trusted. Usefully there is a tax-free allowance of 11700 per year for UK based investors. 13 Point Summary on New Zealands Trading Regulations.

What Is The Minimum Deposit To Trade With An New Zealand FX Broker. Plus500 - Trusted broker great for beginners. In New Zealand individuals or businesses offering these contracts must hold a derivatives issuer license from FMA.

Forex futures and options are 1256 contracts and will be taxed according to the 6040 rule. Forex trading is the buying and selling of foreign currencies. The basic theory is that if you make an investment with the intention of holding on to it for the long term then gains made arent taxable.

60 of gains or losses will be treated as long-term capital gains and the remaining 40 as short-term. We opened a real account and deposited between 4000 and 5000 with each broker. Richard Meadows 0500 Mar 19 2017 ILLUSTRATION.

The tax amount is 18 of the taxable value so the final GST amount falls between Rs 990 and Rs 60000. NZ Tax Forex Trading To come up with this list we have tested several forex brokers holding FMA licenses in New Zealand. April 4 2013 1238 AM UTC in News.

Our experts have compiled a list of the most essential. No all the traders are required to pay tax on their income from Forex trading. Greater than Rs 10 Lakh.

Sharesight makes it easy to calculate gains or losses for share traders in New Zealand with our Traders Tax report. But I dont know if I should pay taxes on my gains.

Should You Enjoy Online Investments An Individual Will Really Like This Cool Site Trade Finance Investing Forex Trading

Forex Trading Academy Best Educational Provider Axiory Global

Forex Trading Nz Best Forex Brokers Regulation Taxes

Stock Graph Analysis Stock Market Data Stock Market Forex Trading

Forex Trading Academy Best Educational Provider Axiory Global

Forex Trading Nz Best Forex Brokers Regulation Taxes

Which Country Is Best For Forex Trading

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Suspended Medium Forex Brokers Online Forex Trading Forex Trading

10 Best Platforms For Forex Trading In Germany In 2022

How To Trade Forex Forex Trading Step By Step Benzinga

Forex Trading Nz Best Forex Brokers Regulation Taxes

Chapter 11 Forex Trading Aud Nzd Spot Forex Example My Trading Skills

/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)